Consider placing a permanent Security Freeze on your credit report.

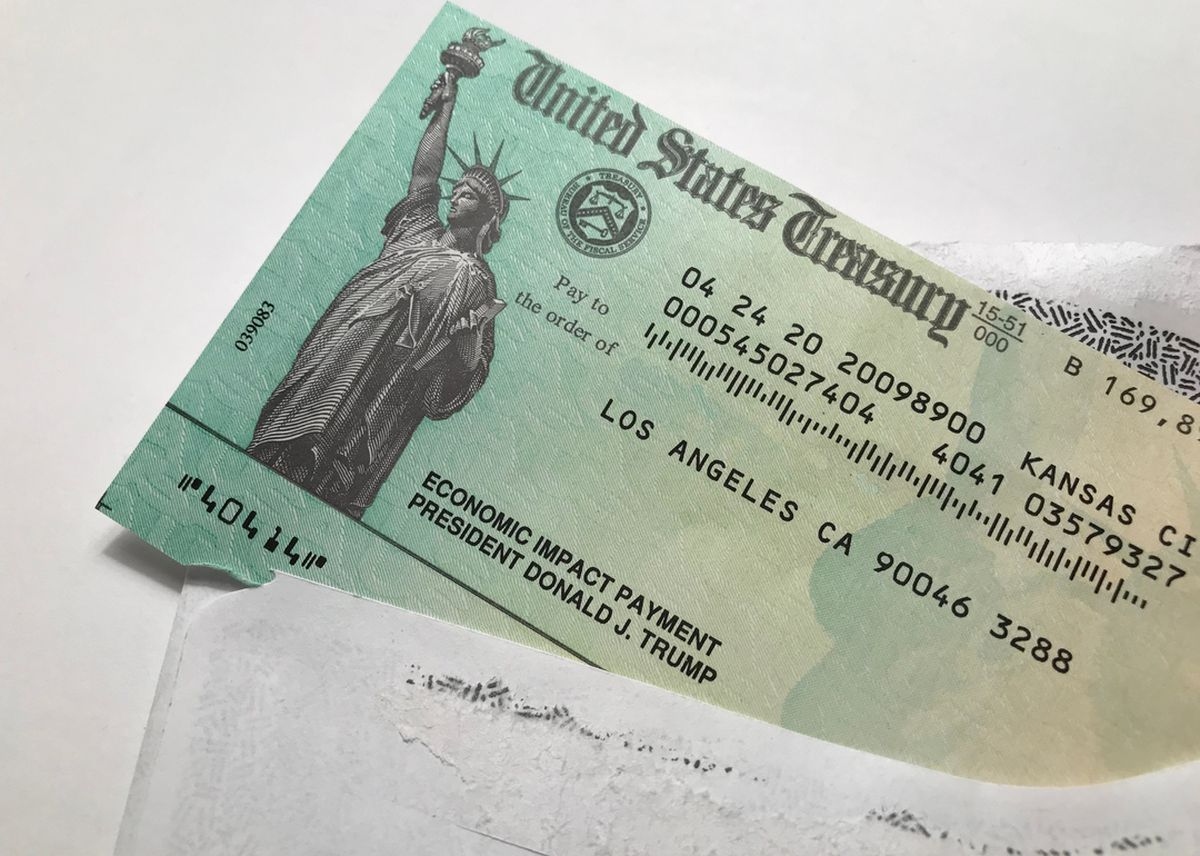

Note that the payments will arrive as a tax refund for taxpayers who filed their taxes on time. There is no charge to place an Initial Fraud Alert. The state government offers one-time payments of $75 for each family member, or the equivalent of 12% of the taxpayer’s tax liability. Payments will be issued in the first half of 2023. This means people will not receive a 2021 payment if their AGI is at least. The payment is made possible by the “Middle Class Tax Rebate,” which will be available to taxpayers who filed their 2020 tax return before Octoand lived in California full-time for a minimum of six months in 2020. The Act provided for a third round of stimulus payments of up to 1,400 per.

In-state residents can get a payment of $200 to $1,050, depending on their eligibility criteria, such as income, marital status, and number of dependents. 6 states with stimulus check projects for 2023: Which states and how much? California This has prompted some states to offer their own help in the absence of a fourth federal stimulus check. In addition to the health crisis, the covid-19 pandemic brought with it economic problems, to which the US government responded by approving three stimulus checks with the aim of providing economic assistance to those most in need.Īlthough the pandemic has reached manageable levels, inflation continues to be high and many families continue to have difficulties with putting food on the table.

0 kommentar(er)

0 kommentar(er)